SGX Catalist-listed AsiaMedic Limited (“AsiaMedic” or the “Group”)’s latest half-year financial results ended 30 June 2025 (“1H2025”) reveal a company executing on a long-term plan to position itself at the forefront of diagnostic imaging and preventive care in Singapore.

AsiaMedic reported a 26% year-on-year increase in revenue to S$16.6 million in 1H2025, compared to S$13.2 million in 1H2024. The growth was led by the Group’s diagnostic imaging business, supported by contributions from its flagship Shaw Centre clinic and the newly opened Novena imaging centre. EBITDA attributable to owners of the Company maintained at S$1.3 million despite the cost pressures of a new facility.

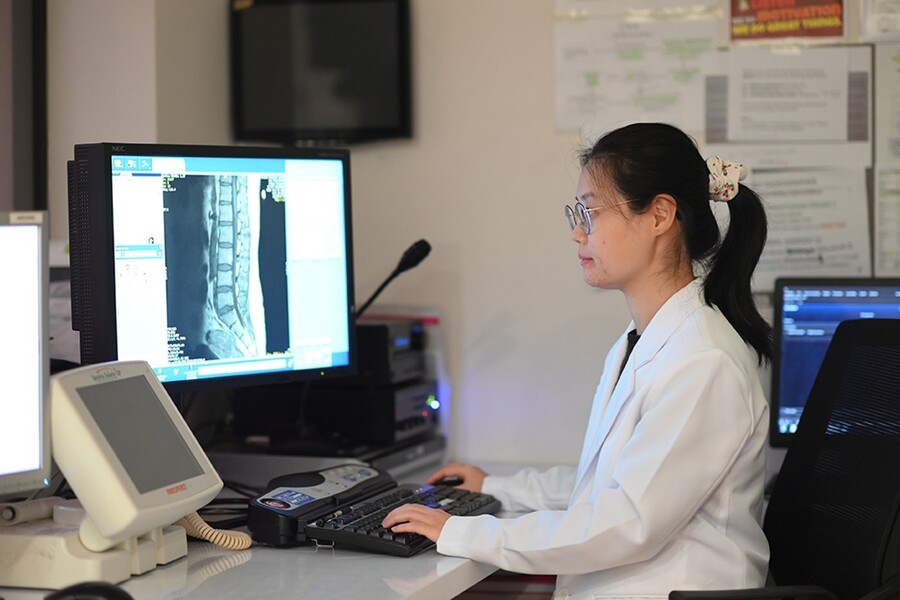

Over 60% of the Group’s 1H2025 revenue came from its diagnostic imaging operations, powered by sustained patient volumes at its flagship Shaw Centre clinic and early contributions from its newly opened Novena imaging centre. In Singapore, diagnostic imaging is increasingly a frontline tool in early disease detection.

Singapore’s ageing population have made early diagnosis an economic and medical necessity. AsiaMedic’s choice of locations is not incidental — Orchard and Novena are not only high-traffic medical precincts, they also attract both local and international patients seeking medical services.

AsiaMedic closed 1H2025 with a strong liquidity position, with S$4.9 million in cash and cash equivalents and S$3.7 million in financial assets, providing a solid foundation to support ongoing investments and operational needs.

The narrowing of net losses attributable to owners of the Company from S$104,431 in 1H2024 to just S$38,603 in 1H2025 is more than a cosmetic improvement. It shows that core operations are profitable and that the cost from expansion is well-managed.

Mr Arifin Kwek, Chief Executive Officer of AsiaMedic Limited, said, “Our performance in the first half of 2025 reflects the continued strength of our diagnostic imaging business. Shaw Centre remained our primary growth engine with sustained patient volumes, while the newly opened Novena Centre, though still ramping up, has already begun contributing. These investments will further position us as a trusted provider of early detection and preventive care in Singapore.

Our health screening and medical wellness segment remained stable, underpinned by the government awarded Grow Well SG programme and steady corporate wellness demand. While the opening of Novena has added to our cost, these are deliberate investments in capacity, technology, and skilled professionals in a key medical geographical location in Singapore, that position us for long term growth.”

While diagnostic imaging is the headline driver, AsiaMedic’s health screening and medical wellness segment remains an important revenue stabiliser. The steady performance here is underpinned by the government’s Grow Well SG programme and by consistent demand from corporate wellness contracts. For AsiaMedic, these provide recurring revenue.

AsiaMedic remains focused on expanding its diagnostic imaging and medical wellness businesses in alignment with Singapore’s preventive healthcare agenda. The Group’s presence in Orchard and Novena positions it to serve a broad patient base while capturing demand from both domestic and international markets.

“We will continue to build on this foundation, focusing on scaling our imaging and health screening businesses while ensuring we deliver high quality, patient-centred care. With expanded capacity and prudent cost management, AsiaMedic is well placed to capture growth opportunities in Singapore’s healthcare sector,” Mr Arifin Kwek added.

Ongoing investments in technology, infrastructure, and talent are expected to enhance service quality and operational efficiency.

As Singapore’s healthcare sector continues to grow, AsiaMedic aims to strengthen its role as a trusted provider of accessible, high-quality diagnostic and preventive healthcare services. AsiaMedic will continue to pursue opportunities for growth while maintaining prudent cost control to support sustainable financial performance.