In Part 2 of this series, we continue from the previous article with another Case Study. You can read Part 1 here.

An Investor Relations professional is not a financial adviser to a company. But corporate developments often do have an impact on the company’s investor relations. This is because corporate developments may affect shareholder or potential investor sentiments, alter the company’s IR narrative and messaging, and affect the corporate brand equity.

As an Investor Relations professional, when proposed corporate developments are brought to your notice by the company’s C-Suite, it is your responsibility to analyze the potential impact of such developments on the company’s investor relations and give your take on the possible impact to the C-Suite.

Corporate Development: The CEO of a Company that runs a chain of low-cost pizza parlors tells you that he wants to diversify into the semiconductor manufacturing business via an acquisition since “semiconductors are hot now”, a business that seems very unrelated to his current business. He asks for your opinion.

Here’s how you can use data analysis to give your take on the proposed corporate development to the CEO:

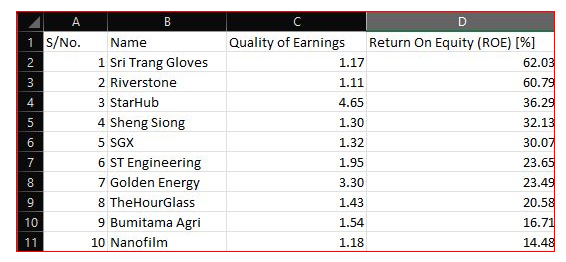

Use a stock screening tool to filter for the following two financial ratios: Quality of Earnings>1 AND Top 10 stocks by ROE. Then sort the spreadsheet to rank descending by ROE %. Now, read up on the business of each stock.

You can show him that in general, companies that stick to their core business have a higher ROE %. (Return On Equity). And the metric used for measuring significance of core operations in company financials is Quality of Earnings (QOE) where QOE=Earnings/ Cash Flow from Operations, and QOE>1 is positive.

As an example, the Quality of Earnings Table below lists the top 10 ROE % companies on SGX Mainboard and they all have QOE>1. Sri Trang and Riverstone stock to medical gloves, Starhub is a pure Telco, Sheng Siong a supermarket chain, and The Hour Glass sells watches. SGX is of course a purely financial services company, Bumitama Agri the oil palm plantation business, Nanofilm sticks to its business in nano-dimension materials. And so on.

Data and data analytics can add value to an Investor Relations professional’s work.